Yeonjun's worries about currency exchange due to interest rate hike

The Federal Reserve announced it would raise interest rates

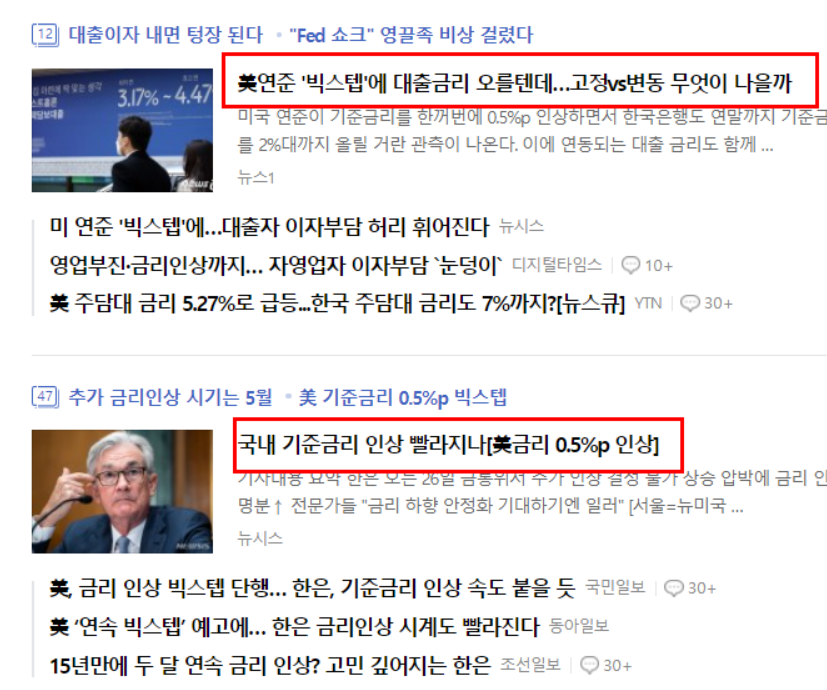

Recently, there has been an article in the news that the US will start raising interest rates in earnest. After going through a difficult period for a while, I had released a lot of money to the market, so it was a natural procedure. The Federal Reserve has decided to raise the base interest rate by more than 0.5 percentage points for the first time in 22 years. What does this mean?

Let's take a closer look at the article first. It is said that the performance will raise the interest rate in earnest in the future. It has already taken a big step to raise the base interest rate by 0.5% at a time, but it is said that there will be two or three big steps in the next six meetings this year.

We all know the saying that when the US sneezes, Korea catches the flu.

As a result, experts predict that the Bank of Korea will also raise interest rates in the future. The important thing is not just to raise interest rates. It is said that the possibility of reversal of interest rates between Korea and the United States should be considered as well as prices.

Many people are worried that this will lead to domestic household debt problems. In particular, there are many people who are worried about getting a lot of loans for rent for a while. Even if the unit is small, it will be fine, but for those who received hundreds of millions of units, even if the interest rate rises a little, the annual repayment amount will increase to more than 100 units. Despite this phenomenon, some say it would be wise for homeless people not to buy houses now. I suspect all of this is ultimately about interest rates. In addition, since it is rare for housing prices to soar like they did in the past, many people are making such warnings.

Of course, investing is a decision made by the person himself/herself, and it cannot be known until he/she directly experiences how the market economy will return. Therefore, it is very difficult to predict the economic situation realistically and accurately. This is exactly why genius scientists like Newton failed in stocks. We have to see how people's emotions translate into economic conditions.

Future economic prospects

What will happen to the market economy in the future? Anyway, as the US made the announcement, it seems natural for South Korea to raise interest rates as well. According to the article, it was the first time in 22 years since the dot-com bubble in 2000 that the benchmark interest rate was raised this much.

So, looking at the economic indicators after the dot-com bubble, are they a little predictable about the future?

But I expect that to be impossible. This is because the domestic and overseas situations are becoming excessively unstable, and various unexpected problems make it impossible to predict the future. Just look at the situation in Russia right away. I was surprised to find that some people didn't think this condition had any direct effect on them.

It is said that the prices of various raw materials, as well as the seafood market, are high due to honor. In particular, resource shortages such as South Korea are greatly affected by overseas influences, but it is expected that the relationship with Russia and China, as well as price rises in the United States, will have a large impact on future economic indicators.

Should I sell my dollars?

Especially if you have a lot of dollars, you have to exchange money, but you will have a lot of worries. This is because in the age of earning money from content like these days, there are many people who generate revenue in dollars through AdSense. Of course, there are many other people who also receive money in dollars through exports.

But I learned that making money on the exchange rate is more difficult than investing in stocks. How did a college professor tell you not to even dream of trying to get foreign exchange gains instead of stocks? The process itself is also complex, with so many elements combined that it is almost impossible to predict with any accuracy.

Looking at the indicators so far, it can be seen that the won-dollar exchange rate and the national solid-state interest rate chart have moved together. In other words, when interest rates were raised, the exchange rate rose, and when interest rates fell, the exchange rate fell. But now, looking at the global situation, Russia is still the problem.

Looking at the US's response to the current Russian situation, Korean economists feared that the US dollar would lose its credibility. In the midst of such a mixture of various complex elements, what can we do? It seems that the right answer is to leave it to luck at this level.

A surprisingly easy way to make money at home

The era of full-fledged work from home has begun. Times have changed. It seems that a big company is seriously discussing working from home. Instead of just coming out w..

helpfulplace.tistory.com